Get This Report on Mortgage Broker Assistant

Wiki Article

About Mortgage Broker Meaning

Table of ContentsSome Of Broker Mortgage MeaningThe Ultimate Guide To Mortgage Broker Average SalaryThe 8-Second Trick For Mortgage BrokerageThe Basic Principles Of Mortgage Broker Association What Does Mortgage Brokerage Mean?Mortgage Brokerage - TruthsFacts About Mortgage Broker Meaning UncoveredSome Of Broker Mortgage Rates

What Is a Mortgage Broker? The home loan broker will certainly work with both parties to get the private authorized for the lending.A home mortgage broker generally works with many various lending institutions as well as can provide a range of funding options to the consumer they function with. The broker will gather info from the individual as well as go to several lenders in order to discover the best potential finance for their customer.

Rumored Buzz on Mortgage Broker Average Salary

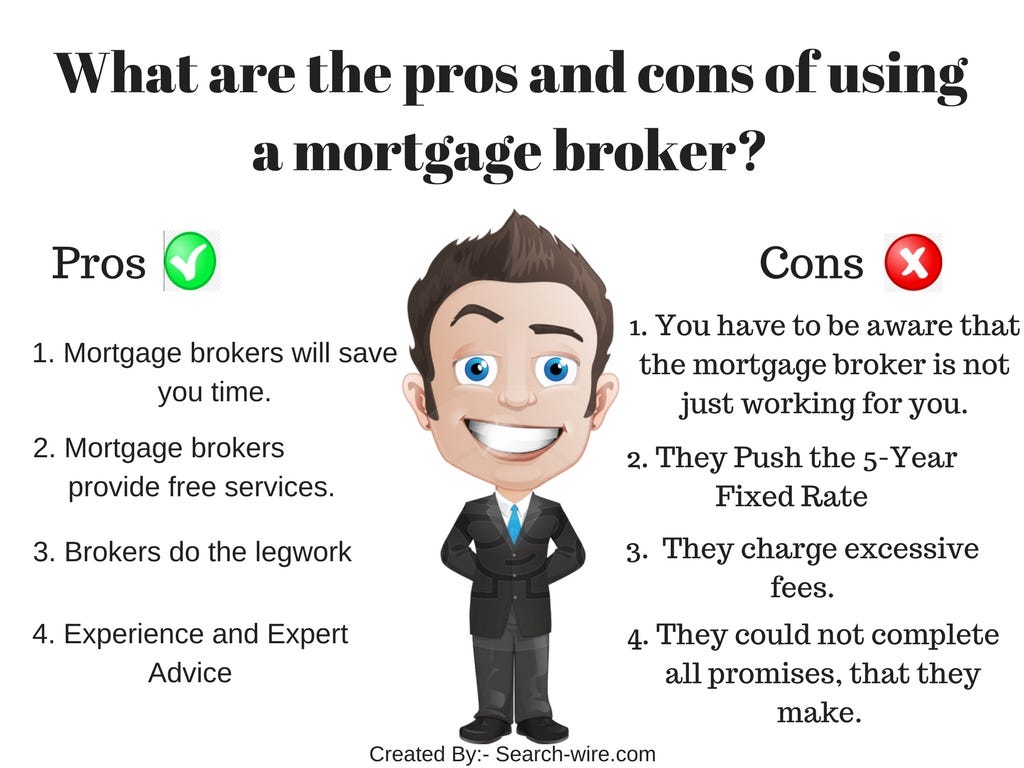

The Base Line: Do I Need A Home Loan Broker? Working with a mortgage broker can conserve the borrower effort and time during the application process, and potentially a great deal of money over the life of the loan. Furthermore, some lenders work solely with home mortgage brokers, suggesting that debtors would certainly have access to car loans that would certainly otherwise not be offered to them.It's important to analyze all the charges, both those you may have to pay the broker, along with any charges the broker can aid you prevent, when evaluating the decision to deal with a home mortgage broker.

The Best Guide To Mortgage Broker Job Description

You've most likely listened to the term "mortgage broker" from your actual estate representative or pals that have actually purchased a home. What specifically is a mortgage broker and what does one do that's various from, state, a loan policeman at a bank? Nerd, Pocketbook Overview to COVID-19Get response to questions about your home loan, travel, funds as well as keeping your assurance.What is a mortgage broker? A home mortgage broker acts as an intermediary in between you and also prospective lending institutions. Mortgage brokers have stables of loan providers they function with, which can make your life easier.

How Mortgage Broker Association can Save You Time, Stress, and Money.

How does a home loan broker make money? Home mortgage brokers are most usually paid by lenders, in some cases by consumers, however, by regulation, never ever both. That law the Dodd-Frank Act additionally forbids mortgage brokers from billing surprise fees or basing their payment on a borrower's rate of interest. You can also select to pay the home loan broker on your own.The competitiveness and also residence costs in your market will have a hand in dictating what home mortgage brokers charge. Federal law limits just how high payment can go. 3. What makes home mortgage brokers different from financing police officers? Finance policemans are workers of one lending institution who are paid established wages (plus bonuses). Finance policemans can compose just the sorts of financings their employer selects to offer.

Some Known Facts About Mortgage Broker Meaning.

Home loan brokers might have the ability to offer consumers accessibility to a wide selection of car loan types. 4. Is a home mortgage broker right for me? You can save time by utilizing a mortgage broker; it can take hours to get preapproval with different lending institutions, after that there's the back-and-forth interaction included in underwriting the funding and also making sure the deal remains on track.When picking any type of loan provider whether with a broker or directly you'll desire to pay focus to lender fees. Specifically, ask what fees will show up on Web page 2 of your Loan Estimate kind in the Funding Costs area under "A: Origination Charges." Then, take the Finance Quote you get from each lender, place them alongside and also compare your rates of interest as well as all of the fees and also closing costs.

Little Known Facts About Mortgage Broker Average Salary.

5. How do I select a mortgage broker? The most effective means is to ask pals as well as family members for references, but make certain they have actually used the broker and also aren't simply going down the name of a former university roomie or a far-off associate. Find out all you can about the broker's solutions, communication style, degree of understanding and also method to customers.

Indicators on Broker Mortgage Calculator You Need To Know

Competitors as well as residence prices will affect how much home loan brokers earn money. What's the difference between a home mortgage broker and also a lending policeman? her explanation Home loan brokers will certainly deal with several lending institutions to find the best financing click to find out more for your scenario. Funding policemans help one lending institution. Just how do I find a home loan broker? The most effective method to discover a home mortgage broker is via recommendations from family, good friends and your property agent.

Mortgage Broker Association Can Be Fun For Anyone

Getting a new home is just one of the most complicated occasions in a person's life. Residence vary substantially in regards to style, facilities, college area and also, naturally, the always vital "location, place, location." The home loan application process is a complicated aspect of the homebuying process, particularly for those without previous experience.

Can figure out which issues could produce troubles with one lending institution versus another. Why some buyers prevent mortgage brokers Often homebuyers really feel much more comfy going straight to a big bank to protect their finance. In that case, customers should a minimum of talk with a broker in order to comprehend all of their options concerning the kind of loan and the available price.

Report this wiki page